Forecasting the S&P 500

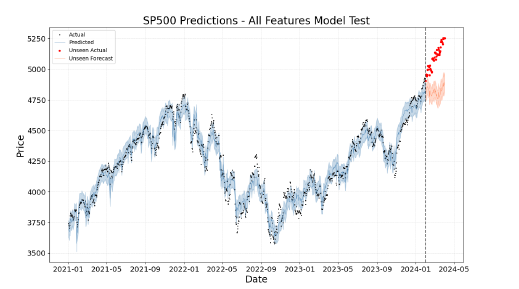

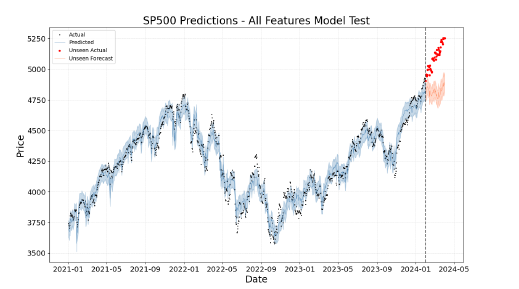

This study explores the challenges and opportunities in forecasting the S&P 500, a benchmark index often used as a barometer of U.S. economic health. By leveraging seven years of historical data (2017–2024) and incorporating diverse features such as economic indicators, news sentiment, and holidays, the study aims to predict the index’s movement over a twomonth horizon. Using the Prophet model, a scalable time-series forecasting tool, the analysis evaluates the predictive power of various data combinations, including baseline market data, economic indices, and sentiment analysis. Results indicate that while the inclusion of multiple data sources improves general trend prediction, pinpointing precise market movements remains elusive, constrained by market noise and inefficiencies. This study highlights the potential of combining diverse datasets for directional market predictions, while emphasizing the limitations of existing models in achieving actionable accuracy. Future work could enhance predictions through refined datasets and advanced machine learning techniques.

For more details, you can read the full report here: Forecasting the S&P 500 (PDF)